Grow with Us Plant Sale!

Get all of your garden needs and help support DFL48! This year, we’re offering you plant cards at both Gerten’s Greenhouses and Garden Center in Inver Grove Heights and Wagner’s Greenhouse in Minneapolis and Bloomington.

Tweets by @DFL48

29

Surprise! Big Business Wins Big in House GOP Plan

J. Patrick Coolican with the StarTribune, presents some of the facts in the House GOP budget plan. We’ve provided information on this over the past days. Mr. Coolican gives some clear information on who benefits from it. And, it isn’t you and me, Mom and Pop businesses or Greater Minnesota that the party said they’d support if they elected their representatives in 2014.

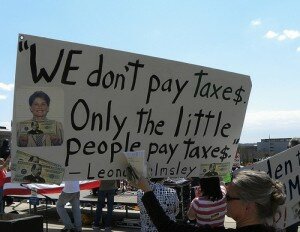

They want to cut property taxes for businesses — $2 Billion. Surprise! And, guess who the big beneficiaries are corporations like that owning the Mall of America and Xcel Energy. The article quotes Rep. Lenczewski:

“The biggest beneficiary is going to be Nader Ghermezian, who’s not even an American citizen,” said Rep. Ann Lenczewski, DFL-Bloomington, referring to the Canadian developer whose family owns Mall of America. Other major beneficiaries, just in Hennepin and Ramsey counties, include utility company Xcel, large property developers from Bethesda, Md., and Chicago, Hilton Hotels, and such major Minnesota companies as Best Buy, Target and 3M, according to data compiled from House researchers and the counties.

“This is creating deficit spending with no way to pay for it,” she said in a recent hearing.

But, what about the people of Minnesota? How are they faring?

Jeff Van Wychen, a consultant to local government who was an aide to Gov. Mark Dayton on fiscal issues during his first term, said the increase for homeowners has been far worse — more than 80 percent since 2002 vs. a 45 percent increase in the statewide business property tax. “There’s no need to concentrate all property tax relief on businesses,” he said.

The statewide business levy drives commercial property taxes above those of other states in the Upper Midwest, especially on rural properties and properties worth $1 million and more, surpassing Chicago property taxes, according to data compiled by Haveman.

Van Wychen said that according to an Ernst & Young study, Minnesota business taxes as a percentage of all state and local taxes are slightly below the national average, meaning businesses here are doing no better or worse than other taxpayers.

We’re fully expecting Rep. Jenifer Loon (R-48B) to side with her party on this. After all, with her background, there’s no other way she could possibly vote.

Again, we ask, which party is the party of fiscal responsibility?

corporate tax giveaways · deficit spending · Minnesota House GOP budget plan

DFL48

DFL48